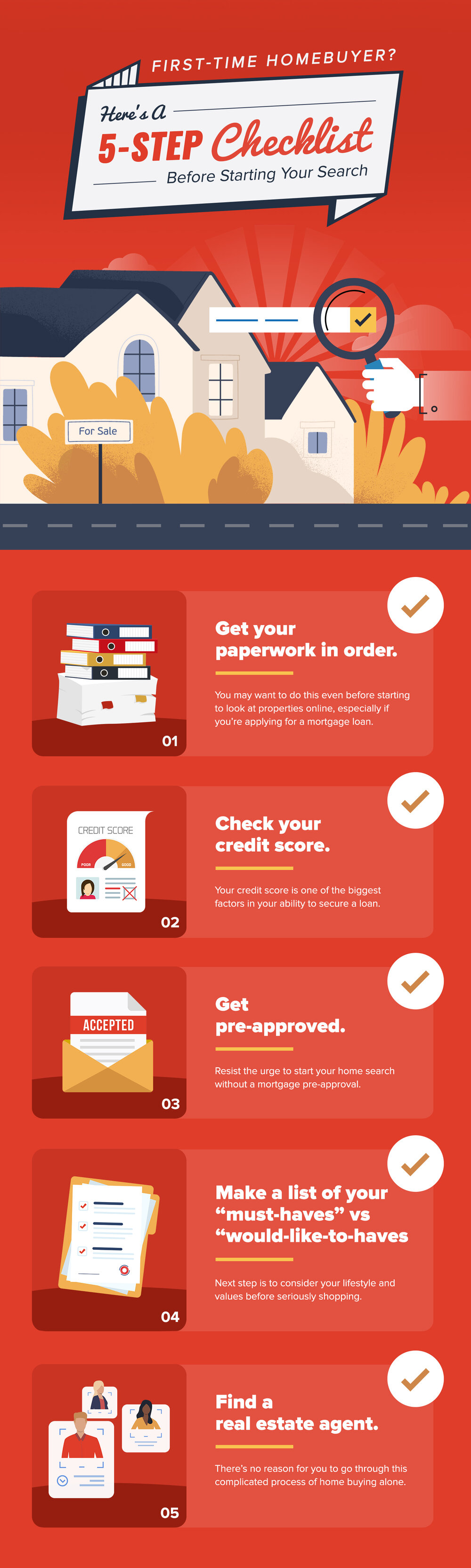

Even so, searching for your first home is an exciting journey. To further help you, here are five tips to remember before starting your search:

1. Get your paperwork in order.

You may want to do this even before starting to look at properties online, especially if you’re applying for a mortgage. Some of the documents you’ll need to prepare include your last two years’ worth of tax returns, bank statements for the last three months, canceled rent checks, and current pay stubs and copies of your lease if you’re currently renting. These documents will be needed by the mortgage officer later on when he’s assessing your capability as a borrower. While assembling all that paperwork early on can be quite a pain, be assured that you’re getting a headstart on the competition.

2. Check your credit score.

Your credit score is one of the biggest factors in your ability to secure a loan. Lenders will look at this number to determine whether you are creditworthy, and it will influence your interest rate, down payment, and other terms of your mortgage. It will also help you know which type of loan you can consider getting as different loan types have different credit score requirements.

Check your credit score and obtain a copy of your credit report before you look at real estate online. If you think there are errors on your report, contact the credit bureau to dispute inaccurate or incomplete information. For less-than-stellar credit, take the necessary steps to boost your score so you’ll be more confident in getting a better loan term as you look for your ideal home.

3. Get pre-approved.

Resist the urge to start your home search without a mortgage pre-approval. This letter lets you know how much home you can afford and will show sellers that you are serious and have what it takes to buy. Lenders will do a full review of your employment or income, credit, and assets before they issue a pre-approval, so assembling your paperwork beforehand will save you the hassle.

Getting pre-approved for a mortgage will help you gain a competitive advantage and speed up the homebuying process. And with today’s historically low mortgage rates and even low housing inventory, it has never been more crucial. Having a pre-approval before making an offer can help you stand out among sellers because it gives them extra security and confidence that the deal will push through.

4. Make a list of your “must-haves” vs “would-like-to-haves”.

Next step is to consider your lifestyle and values before seriously shopping for real estate. Then, create a list of all the features of a home that you would like and categorize them as ‘must-haves,’ ‘would-like-to-haves,’ and your ‘dream features.’

Ask yourself questions like: ‘Do I really need four or more bedrooms?’ ‘Is a two-car garage necessary?’ ‘Are granite countertops a must in my future kitchen?’ Your preferred number of bedrooms and bathrooms, square footage, and neighborhood features should be included in your non-negotiable elements. These crucial items should be followed by the ones that would be nice to have, such as an outdoor space, a home office, plenty of storage, and other features that are important for you and your family.

5. Find a trusted real estate agent.

Lastly, there’s no reason for you to go through this complicated process of home buying alone. Especially during this age of new normal, working efficiently with a trusted realtor will help put you in a position to act fast when you’re ready to move. Find a good realtor who has extensive knowledge of the area or neighborhood, especially if trips outside are still limited